Nickel Market Outlook

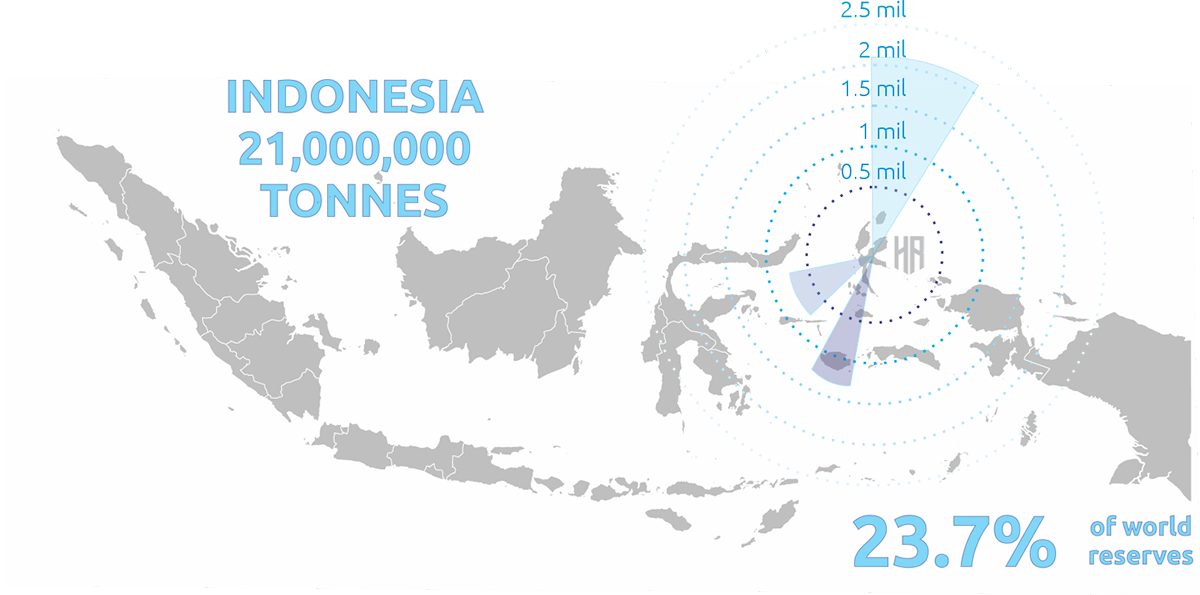

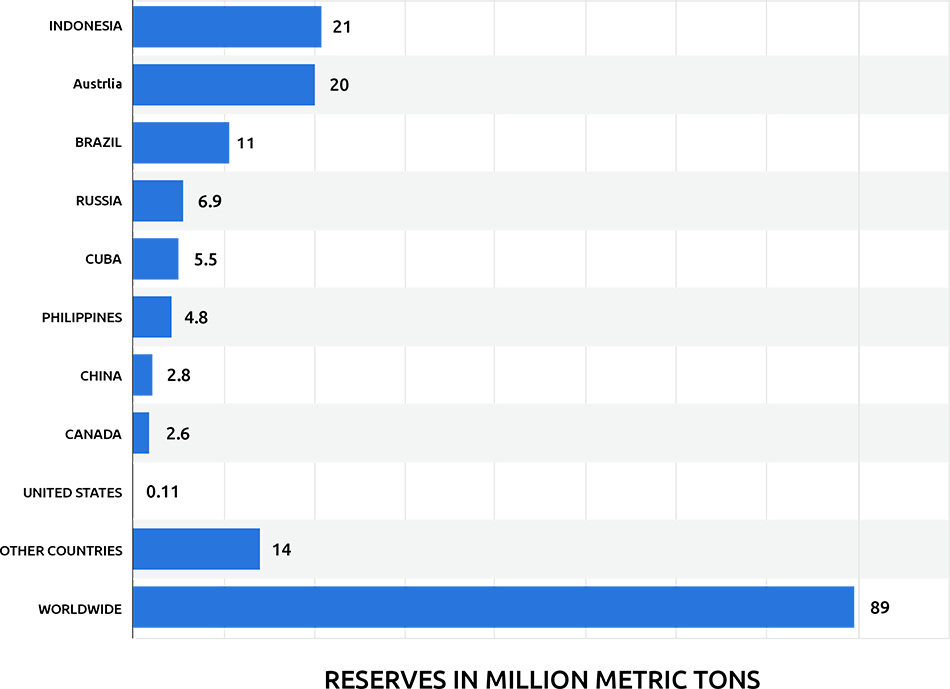

Indonesia, the Philippines, Russia, New Caledonia, and Australia are the top nickel-mining countries. Indonesia also has the world's greatest nickel reserves, followed by Australia and Brazil. Nickel reserves are among the metals and minerals with the shortest remaining life years, however, this is less of a concern because nickel is a highly recyclable commodity.

Raw material availability is described using the terms reserves and resources. According to the Committee on Mineral Reserves International Reporting Standards, a mineral resource is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade, quality, or quantity that realistic prospects for ultimate economic exploitation exist. The economically mineable portion of a Measured and/or Indicated Mineral Resource is referred to as a mineral reserve.

The term reserve denotes a higher level of knowledge and confidence. Exploration is used by mining corporations to transform resources into reserves. In most circumstances, the question of raw material availability is less about whether there is enough raw material in the ground and more about whether there is enough production capacity available in a short period of time to meet a sudden rise in demand.

Indonesia, South Africa, Australia, Russia and Canada account for more than 50% of the global nickel resources. Economic concentrations of nickel occur in sulphide and in laterite-type ore deposits.

Nickel reserves are currently projected to be about 300 million tons around the world. More than half of the world's nickel resources are held by Indonesia, South Africa, Australia, Russia, and Canada. Nickel concentrations that are economically viable can be found in sulphide and laterite-type ore deposits.

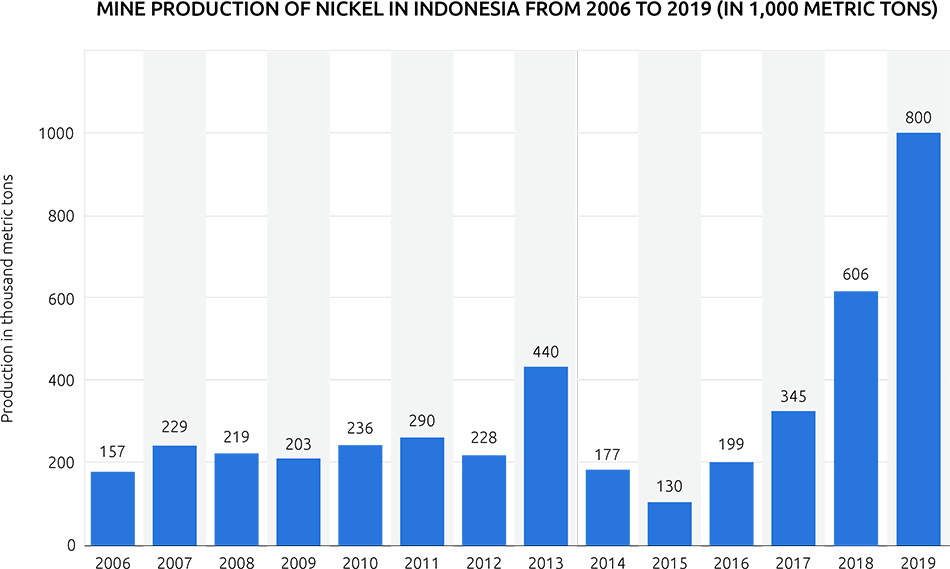

Mine production of nickel in Indonesia from 2006 to 2019 (in 1,000 metric tons)

Even though over 80% of all nickel mined in the preceding three decades has been extracted, known nickel reserves and resources have continually increased. Various factors influence this evolution, including improved awareness of new resources in remote places and increasing exploratory operations by mining companies, which are fueled by low commodity prices. Lower-grade nickel ore can also be processed due to improved mining, smelting, and refining technology, as well as greater capacity. Declining ore grades are thus not always a sign of declining resources, but rather a reflection of advancements in mining and processing techniques.

Significant nickel reserves are also thought to exist in the deep water. Nickel is abundant in manganese nodules, which can be discovered on the deep seafloor. According to recent estimations, such deposits contain more than 290 million tons of nickel. Deep-sea mining technology is likely to make access to these minerals easier in the future.

Nickel reserves worldwide as of 2019, by country (in million metric tons)

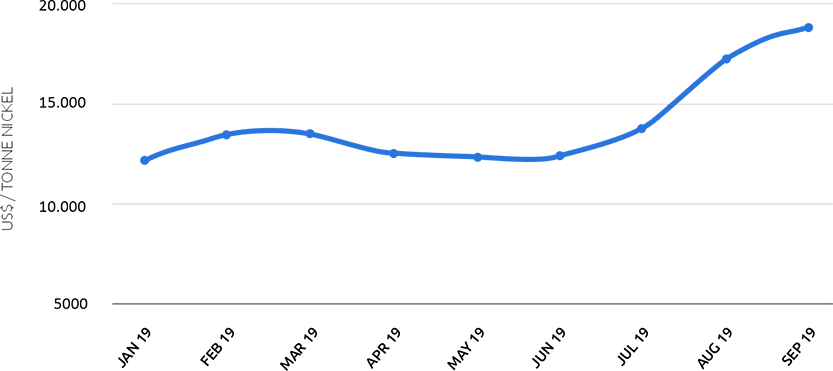

Nickel Price

Nickel prices have been rising since the beginning of 2019, and nickel was the best-performing basic metal of that time. However, it is believed that this is only the beginning of an intriguing journey with a bright future ahead of it.

Nickel prices soared to 16-month highs in August 2019, above $16,000 per ton on key exchanges. In the early days of September 2019, the price climbed even higher, reaching and beyond $18,000 per ton.

As a result of high demand in the stainless-steel sector, combined with significant new demand coming online from the rapidly growing Electric Vehicle industry, the nickel price has risen roughly 70-80% year-to-date. Many analysts believe that prices will continue to rise, and we are seeing an increase in investor interest in the nickel market.

Nickel's position will be strengthened and the long-term outlook will be reaffirmed if larger deficits recur. Leading nickel market analysts predict that a 60 kt annual average deficit from now through 2027 will reduce stock days of consumption to under 100 days for the first time since 2006, bringing nickel prices closer to US$25,000/t by 2025 and US$28,000/t by 2027.

Due to rising demand from stainless steel sectors, the global nickel market is expected to rise at a rapid pace throughout the forecast period. Nickel's capacity to tolerate severe temperatures and lend strength to steel is driving demand for the metal in construction, transportation, and a variety of other end-user industries around the world. Furthermore, the high speed of industrialization in developing economies such as China and India is encouraging the use of nickel in the production of industrial machinery, iron-nickel alloy tankers, and other products, which will drive the market through 2025.

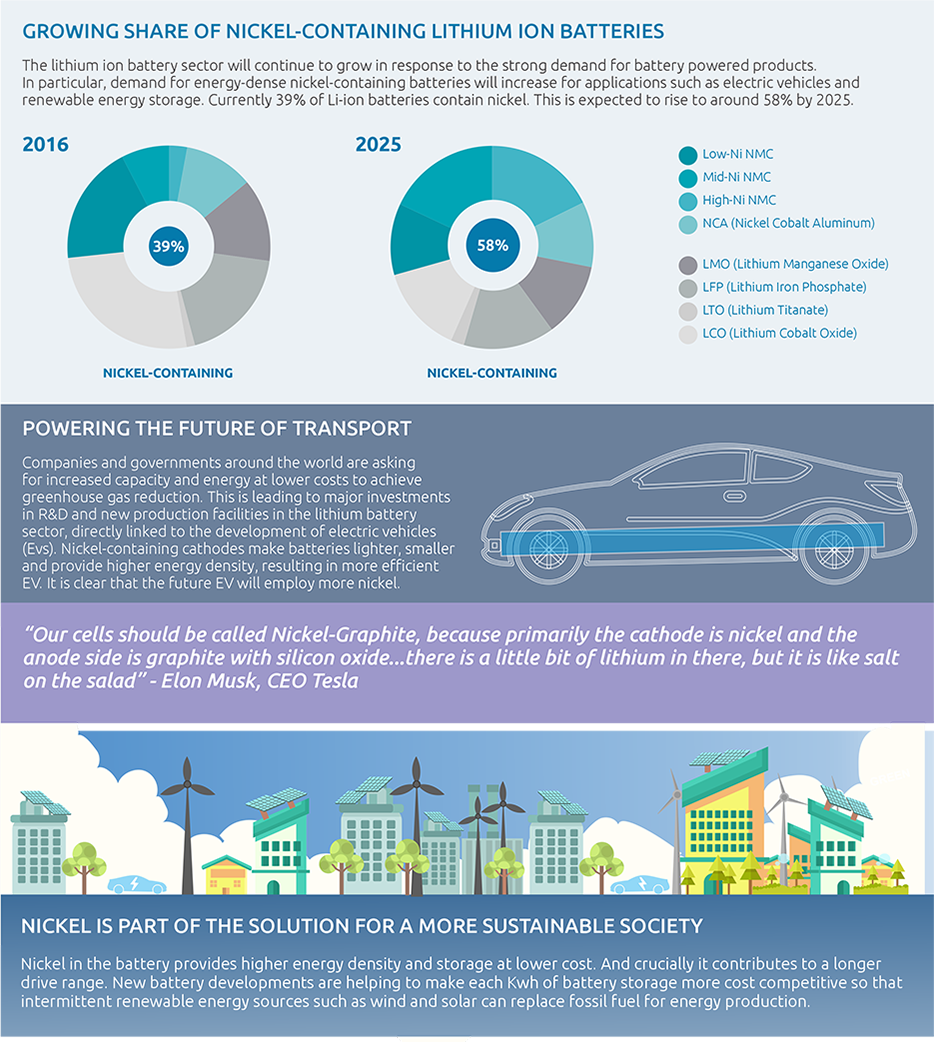

Nickel is also used in the industrial sector to reduce fuel usage, environmental consequences, and shipment losses. It is also widely employed in the production of high-density nickel-based batteries to fulfill rising power demands. Furthermore, the current expansion in the battery and electric car industries is predicted to boost demand for NCA and NCM Li-ion technology, resulting in a significant increase in the worldwide nickel market in the future years.

The global nickel market may be divided into four categories: type, application, end-user industry, and location. The market is divided into stainless steel and alloy steel, non-ferrous alloys and superalloys, electroplating, and others based on application. Among these, nickel is in high demand for the production of stainless steel, which is in high demand from a variety of industries, including food and beverage, household, transportation, and the medical industry. Stainless steels are corrosion-resistant and long-lasting, thus the market is likely to increase significantly in the coming years.

Due to the huge number of stainless-steel manufacturing businesses in the area, Asia Pacific held the greatest market share and is likely to continue to dominate the market by 2025. Furthermore, the region is home to a slew of premier battery manufacturers, and electric vehicle production is booming. As a result, the region is a larger market for nickel producers.

Demand

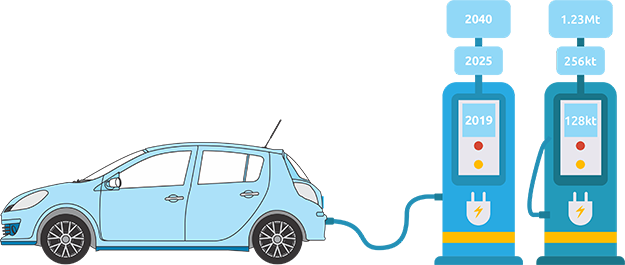

By 2025, global stainless melt production is predicted to increase by approximately 15%. Non-stainless demand is expected to grow at a rate of about 5% per year, from around 750 kt in 2019 to 980 kt in 2025 and 2.11 Mt in 2040, according to analysts. Our projections for nickel use in Li-ion batteries for electric vehicles and energy storage, which we expect to accelerate from the middle to the end of this decade, are driving this continuous period of robust growth. Nickel consumption from EVs is expected to rise from 128 kt in 2019 to 265 kt in 2025 and 1.23 Mt in 2040.

Market Overview

The nickel market is expected to grow at a speedy rate. The increased demand for corrosion-resistant alloys in the oil and gas industry is a major factor driving the market research.

- Volatility in the supply-demand environment is projected to impact the market's expansion.

- Growing popularity of electric vehicles is likely to act as an alternative in the future.

- Asia-Pacific dominates the global market with the highest consumption.

Rising Demand for Stainless Steel

- Stainless steel is utilized in a variety of industries, including food and beverage, household, transportation, medical, and chemical, due to its corrosion resistance, durability, and widespread availability.

- Nickel is essential in the production of stainless steel. It is one of the most often utilized commercial alloy grades in stainless steel manufacture. Nickel alloying accounts for over two-thirds of the stainless-steel manufacturing process worldwide.

- Nickel also helps to stabilize the austenitic structure of stainless steel at room temperature, which is one of its main benefits. In general, the most often used grade of stainless steel contains 8% nickel.

- Stainless-steel production climbed recently. Due to expanding stainless-steel manufacturing, which employs a large proportion of primary nickel units, this ratio has risen in recent years.

- Stainless steel mills consume more than half of the main nickel. Other main stainless-steel production regions are smaller and therefore get more nickel from stainless steel scrap than they do from primary sources.

- The demand for nickel is expected to rise in the future due to the positive growth of stainless steel.

Asia-Pacific Dominates the Market

- The Asia-Pacific region accounts for the majority of nickel consumption. This is primarily owing to the presence of significant stainless-steel and battery production enterprises.

- Major nickel ore concentrations in the Philippines, New Caledonia, Australia, Indonesia, and China have helped the area become the world's largest nickel producer.

- The strong growth will enhance demand for nickel consumption in the region.