HALMAHERA PROJECT

PROJECT DESCRIPTION

Location: South Halmahera Regency, North Maluku Province, Indonesia.

The Project area includes previously mined territory and is spread over three properties.

The Project's accessibility to existing infrastructure is one of its competitive benefits. The Project is 35 km from a source of high-voltage electricity from the electrical grid, 65 km from a rail line, and has suitable access to the site via bitumen roads. The major centers have solid infrastructure, including transportation, maritime ports, and rail stations, which can all meet the Project's requirements.

Geological Overview

The deposit is a massive, flat, continuous nickel laterite deposit with cobalt and locally increased platinum and scandium. A mineralized layer up to 40 meters thick covers a 4 km x 2 km region and lies 0–30 meters beneath the surface.

The deposit is an iron-rich oxide nickel laterite with higher-than-normal quantities of cobalt and platinum and scandium, as well as regionally enhanced platinum and scandium. Over an ultramafic intrusive complex, the deposit has grown. The laterite thins out over pyroxenites and lies above a serpentinized dunite core (dunite complex).

Mineral Reserve

Nickel, cobalt, platinum, and scandium are all included in the deposit, which can be exploited using open-pit mining techniques. The economically mineable portion of the measured and indicated resource is included in the Mineral Reserve. It accounts for mining dilution as well as mining losses. Mining, metallurgical, economic, marketing, legal, environmental, social, and governmental factors are all accurately estimated through appropriate assessments and studies. These evaluations demonstrate that extraction can be justified at the time of reporting. The total current Mineral Reserves show a mining life of more than 20 years. The pit design includes 0.3 million tonnes of inferred resource, which has been classified as waste and is not included in the Mineral Reserve estimate.

The project will produce up to 20,000 tpa of nickel and 3,000 tpa of cobalt as high-purity sulphates for the lithium-ion battery market, which is rapidly developing.

Project – Key Parameters

|

Key Parameter |

Basis of DFS |

|

|

Mineral Resource Base |

2018 Measured and Indicated Resources |

|

|

Mineral Reserve |

2019 Probable and Proven Reserves |

|

|

|

|

|

|

Life of Mine |

20+ Years |

|

|

Life of Mine for Financial Modeling |

15 Years |

|

|

Average Life of Mine Strip Ratio |

1.1:1 |

|

|

|

Years 2-10 |

Years 2-20 |

|

Autoclave Average Feed Grade |

||

|

-Nickel (%) |

0.75 |

0.65 |

|

-Cobalt (%) |

0.15 |

0.10 |

|

Average Metal Production |

||

|

-Contained Nickel (tpa) |

19,230 |

18,840 |

|

-Contained Cobalt (tpa) |

2,320 |

1,810 |

|

Average Sulphate Production |

||

|

- Nickel sulphate (tpa) |

80,300 |

74,250 |

|

- Cobalt sulphate (tpa) |

19,100 |

12,860 |

|

Average Recoveries |

||

|

-Nickel (%) |

90.3 |

|

The Project will produce up to 20,000 tpa of nickel and up to 3,000 tpa of cobalt, as high-purity sulphates for the rapidly expanding lithium-ion battery market.

The Key Competitive Advantages:

- Three high-grade products from a single mine that protect against single commodity price cycles and allow for product mix variation to meet market demand;

- High credits from by-products, particularly from cobalt;

- Low-cost, proprietary process: By combining classic hydrometallurgical flow sheets with patented ion exchange technology, metal recovery is optimized, resulting in decreased capital and unit operating costs, higher purity product, and a smaller process plant footprint;

- Infrastructure: The Project is adjacent to road and rail infrastructure that connects it to key maritime transportation channels, foreign suppliers, and Asian markets;

- Low sovereign risk: Indonesia is regarded as one of the most stable and low-risk countries for resource development, providing supply chain audits with transparency and credibility.

Halmahera Project Main Factors:

Large and Durable Resource

- Projected to be among the world's top nickel mines by annual output;

- Mine life of 20 years with great development potential.

High-Value, Strategic Nickel Product

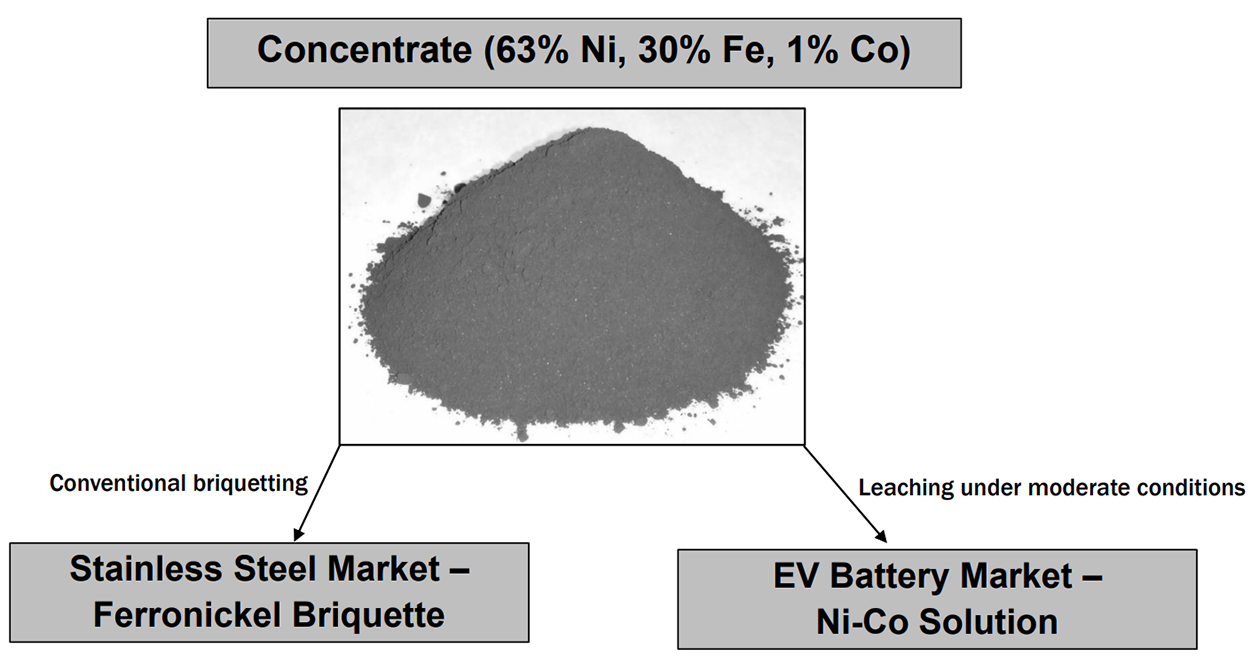

- High-grade nickel product (63% Ni) with low impurities;

- Suitable for stainless steel direct feed and/or the EV battery market.

Low Projected Costs

- Potential for lowest quartile operating costs;

- Low capital intensity in comparison to existing global nickel mines.

Minimal Environmental Impact

- Non-acid-producing host rock;

- No toxic heavy-metal leaching;

- Non-toxic tailings with significant CO2 capture potential;

- CO2 sequestration in tailings, resulting in a zero-carbon footprint.

Conventional Mining and Processing

- Open-pit bulk-tonnage mining with a low strip ratio;

- Flotation recovery after magnetic separation;

- Production of high-grade nickel products and iron concentrate as a by-product.

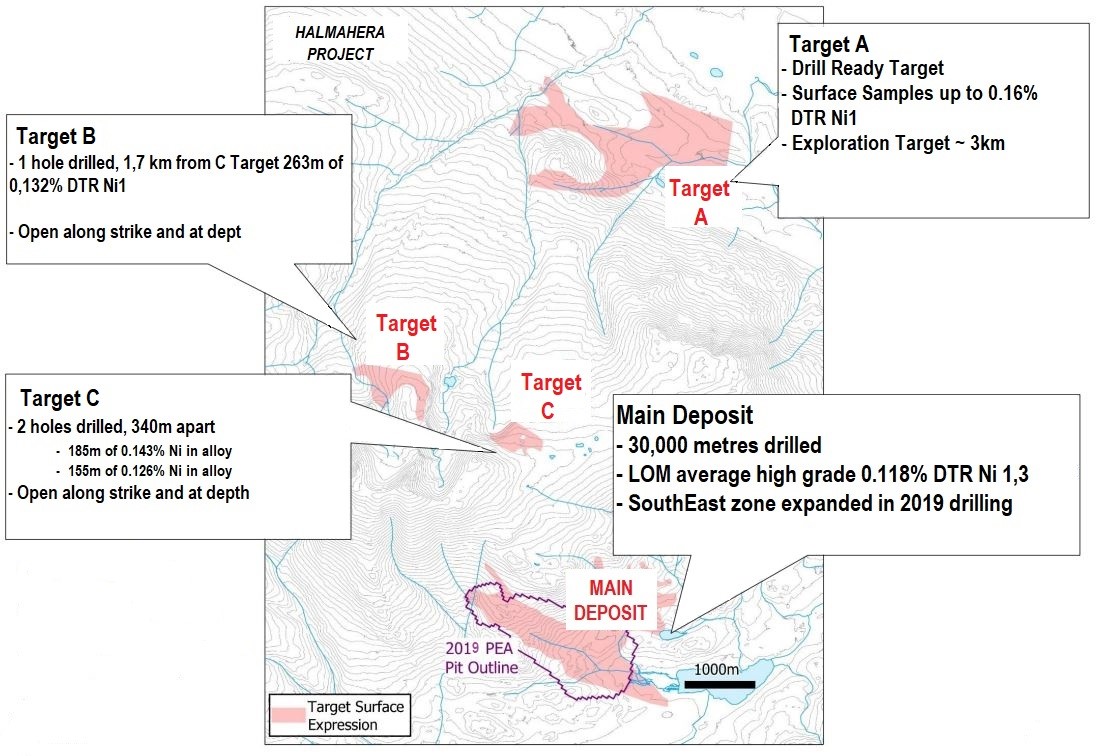

HALMAHERA PROJECT (145 km2)

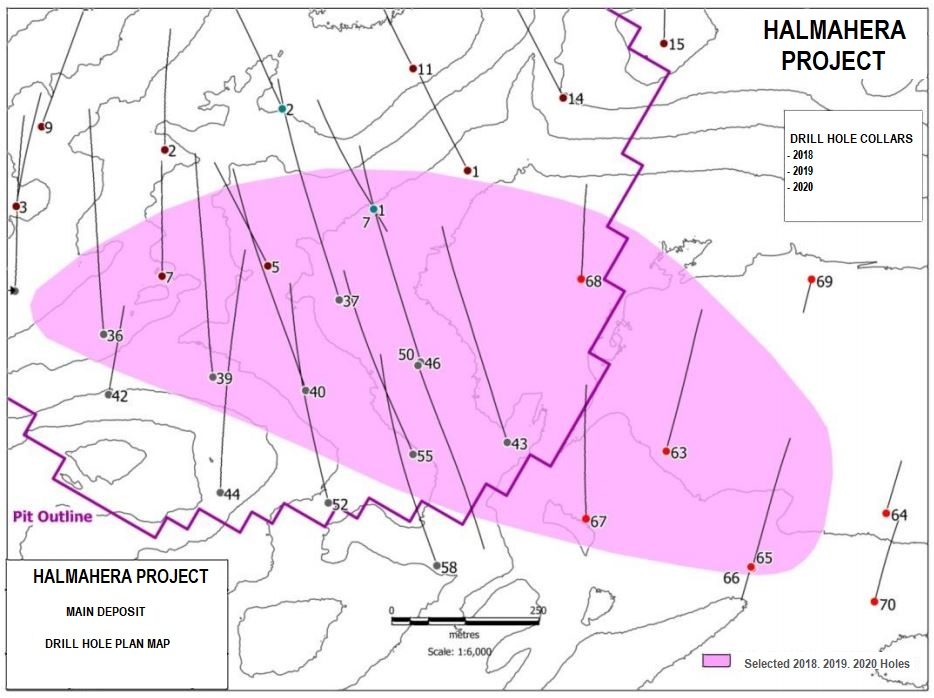

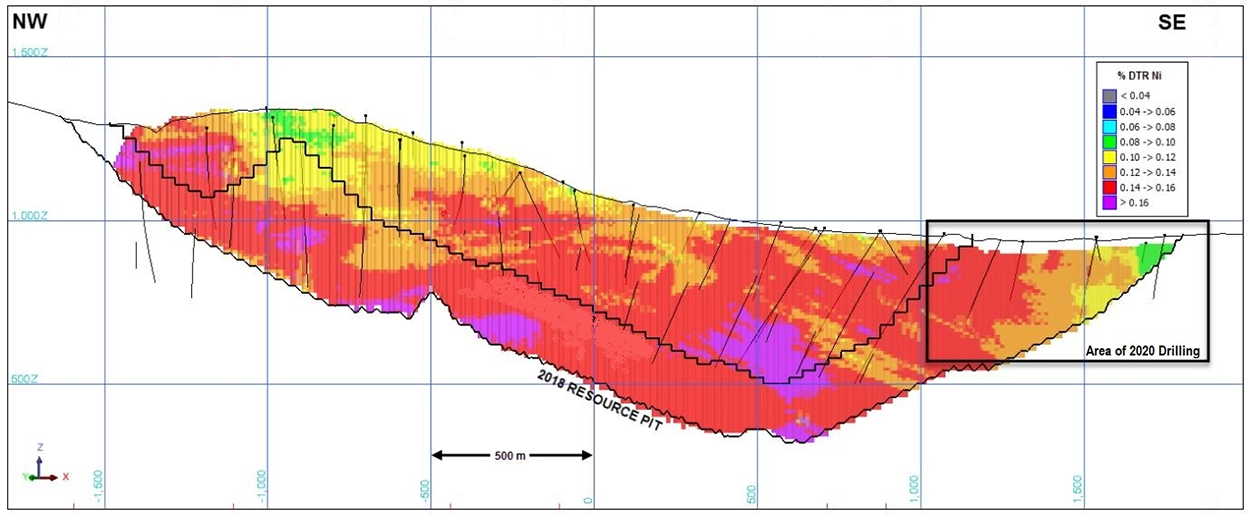

Main Deposit – Step Out Drilling

Southeast Zone (shaded area on map)

- Measures 1,000 meters east-west by up to 600 meters wide.

- High-grade, near-surface potential for starter pit.

- The average grade for holes clustered in Southeast Zone.

|

Hole |

Intersections |

DTR Nickel (%) |

Comments |

||

|

From |

To |

Length |

|

||

|

2018-1 |

3 |

321 |

318 |

0.145 |

|

|

2018-7 |

3 |

71 |

68 |

0.13 |

|

|

2018-5 |

45 |

303 |

258 |

0.145 |

|

|

2018-7 |

51 |

304 |

253 |

0.163 |

|

|

2018-36 |

31.1 |

600.1 |

563 |

0.156 |

Excludes 5.7m dike |

|

2019-37 |

64 |

600 |

494.9 |

0.147 |

Excludes 8.2m and 33m dike sequence |

|

2019-39 |

38.2 |

594.1 |

552.7 |

0.153 |

Excludes 3.1m dike |

|

2019-40 |

33 |

588 |

549.9 |

0.153 |

Excludes 5.1m dike |

|

2019-43 |

33.2 |

600 |

508.1 |

0.151 |

Excludes 22m, 9m, 14.2 m, 3.2m & 9.9 m dikes and minor wall rock |

|

2019-46 |

28.6 |

600.1 |

487.4 |

0.15 |

Excludes 20m, 8m, 14m, 12m & 11m dikes and < 0.1% DTR Ni intervals |

|

2019-50 |

34.5 |

229 |

194.5 |

0.147 |

|

|

2019-55 |

106 |

569.7 |

456.2 |

0.158 |

Excludes 7.4 m dike |

|

2020-63 |

73 |

390 |

317 |

0.121 |

Excludes 4 m, 5 m, 25 m, 2 m, 1m, 1m and 1m dikes |

|

2020-65 |

29 |

351 |

322 |

0.131 |

Excludes 1 m, 8 m, 1m and 2 m dikes |

|

2020-67 |

55 |

349 |

294 |

0.151 |

Excludes 9 m and 1m dikes |

|

2020-68 |

26 |

172 |

146 |

0.128 |

Excludes 1.2 m dike |

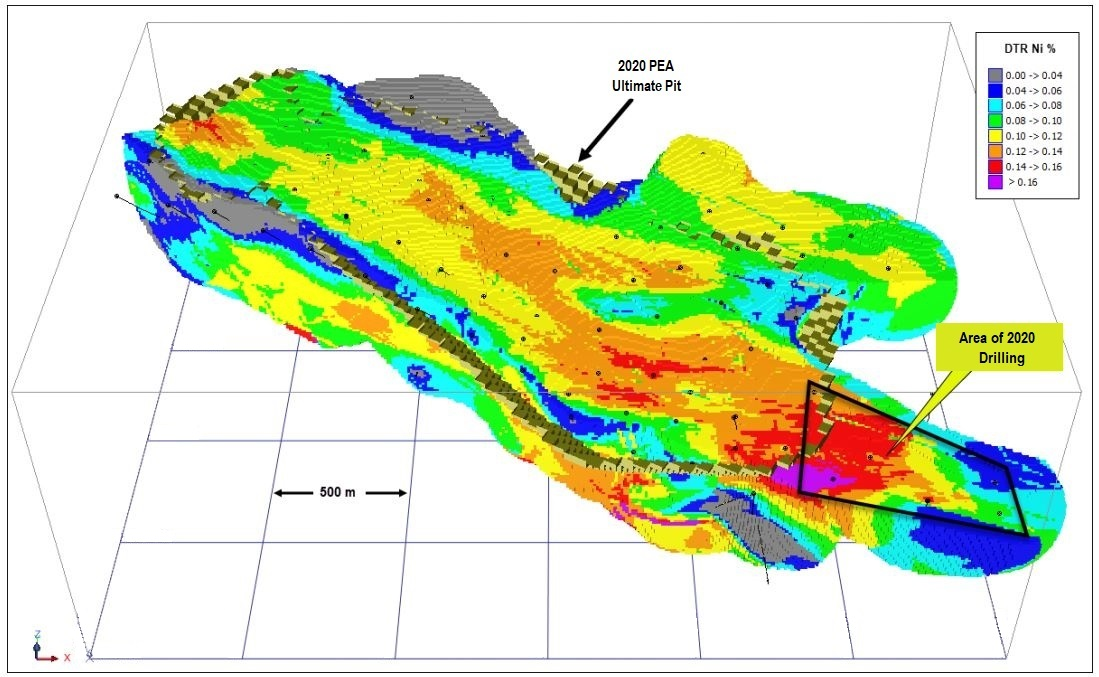

Main Deposit 2020 Mineral Resource Estimate

- The results of step-out drilling completed in the Southeast Zone in 2020 are incorporated into the 2020 mineral resource model.

- By adding near-surface tonnage in a starting pit to the southeast of the 2018 PEA pit, the mine plan is significantly improved.

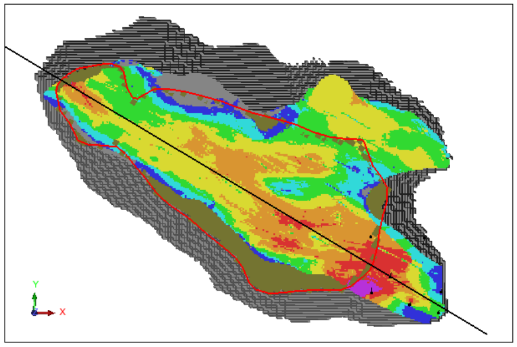

Main Deposit Long Section View

- The results of step-out drilling done in the Southeast Zone in 2018 are incorporated into the 2020 mineral resource model.

- By adding near-surface tonnage in a starting pit to the southeast of the 2018 PEA pit, the mine plan is significantly improved.

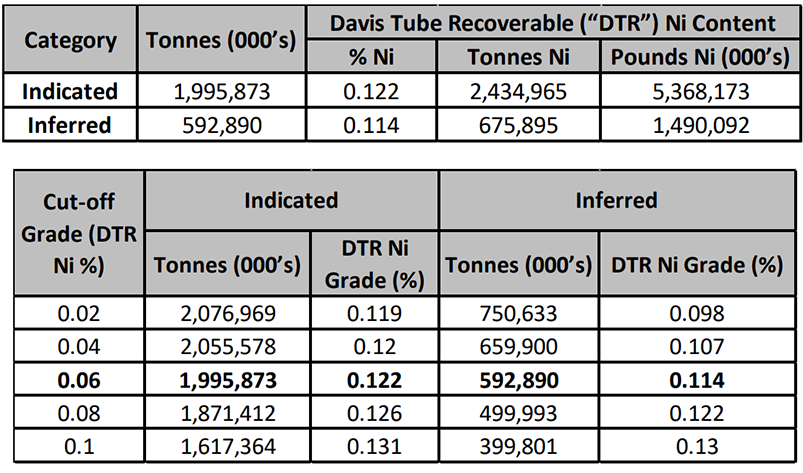

Main Deposit 2020 Mineral Resource Estimate

* Davis Tube Recoverable Nickel”; 0.06% cut-off

- Estimate for 2020 - 2020 mineral resources are reported in relation to a conceptual pit shell and a cut-off grade of 0.06 % DTR Ni inside a resource shell.

- Mineral resources that are not mineral reserves have not been proven to be economically viable. There is a considerable degree of ambiguity about the existence of inferred mineral resources, as well as their economic and legal feasibility.

- It cannot be presumed that an inferred resource, in its entirety or in part, will be upgraded to a higher category.

Comparing 2020 vs 2018 Mineral Resource Estimate

- More advanced model than the previous iteration with a new robust geological model.

- Increased level of confidence (+70 % increase in indicated tonnage).

- Similar total tonnage and grade using significantly lower Ni price assumption.

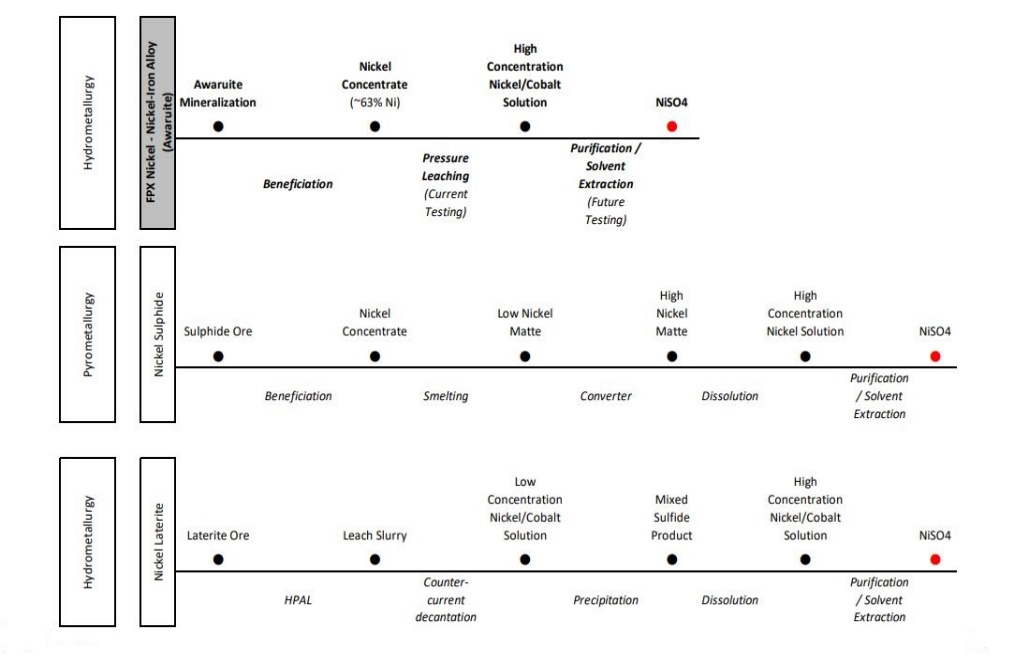

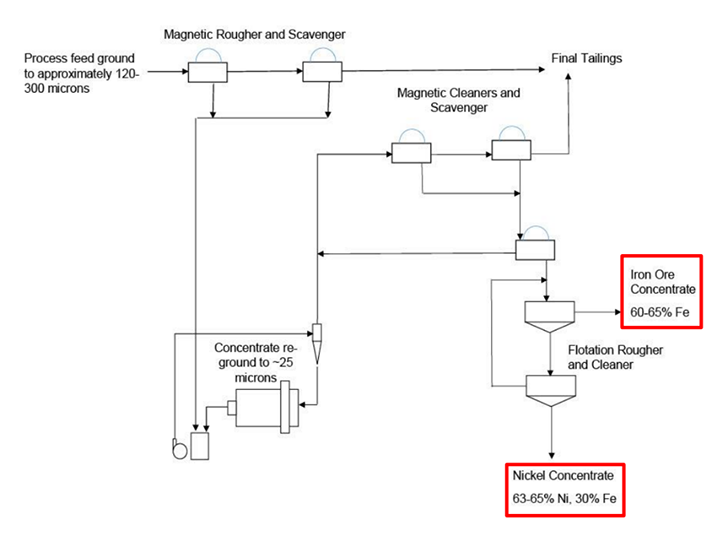

Conventional Metallurgy

A simple process:

- Magnetic separation;

- Conventional flotation, high recoveries, high-grade products;

- 85% recovery of DTR (Davis Tube Recovery) Ni grade;

- Ni concentrate grading 63% Ni and 30% Fe;

- By-product iron ore concentrate grading 60- 65% Fe;

- Nonacid-generating host rock;

- Products with a high metal concentration and low impurities.

|

Parameter |

2018 PEA (Magnetics + Gravity) |

2020 PEA (Magnetics + Flotation) |

|

Ni Concentrate Grade |

13.5% Ni |

63% Ni |

|

DTR Ni Recovery |

82% |

85% |

|

Iron Ore Concentrate Grade |

N/A |

60-65% Fe |

An Integrated Nickel Operation

Premium nickel product suitable for stainless steel and Electric Vehicle (EV) battery markets:

- Direct sell of Sulphate and Co sulphate to stainless steelmakers;

- Bypass smelters of nickel able to produce sulphates at a premium price;

- Chemical feed for nickel;

- High-content nickel and cobalt;

- Conventional process.

The Ni Concentrate Feed for EV Battery Market

- Leach testing reveals that the main deposit awaruite ore has the potential to produce nickel sulphate and cobalt sulphate.

- A simple three-stage process has the potential to be more efficient than the traditional five-stage techniques for converting sulphide and laterite ores into nickel sulphate.

- Rapid nickel extraction under mild pressure leaching conditions with substantially lower scale, power usage, pressure, and temperature requirements than traditional HPAL operations.