INVESTING IN NICKEL

Highlights

- The demand for raw materials for electric vehicles (EVs) is estimated to increase significantly.

- Stainless steel is already in high demand and is expected to continue to rise.

- Limited new nickel projects have advanced in recent years due to low prices.

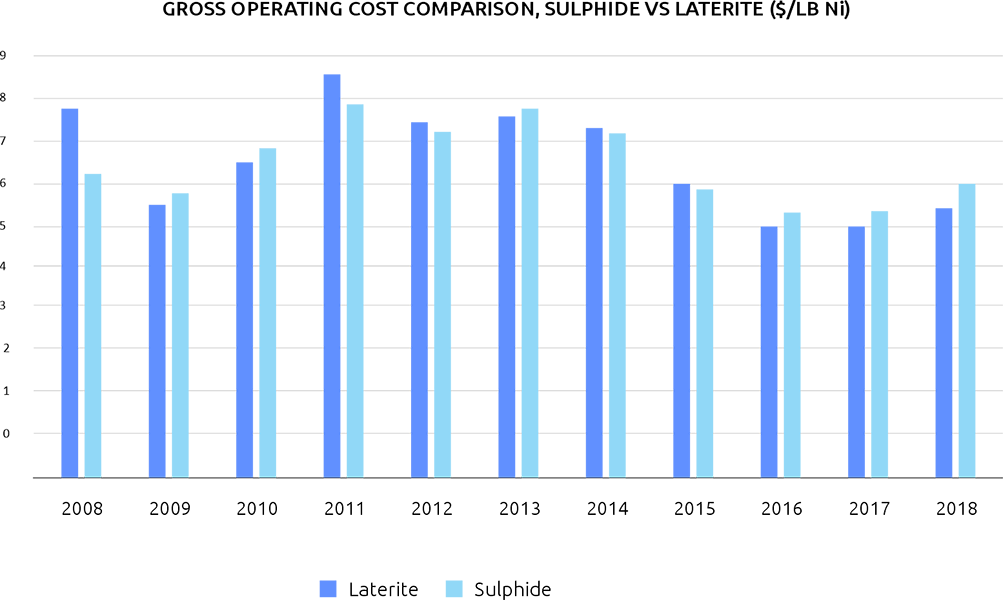

- On an operating cost basis, nickel sulphide operations are currently more expensive than nickel laterite operations.

- Our initiative exposes investors to the stainless-steel nickel market while also demonstrating strong economics.

- The Halmahera Project offers investors exposure to the electric vehicle (EV) battery market, with a Pre-Feasibility Study expected soon.

Nickel market will double in 20 years to 4.014 M tonnes by 2040.

1.23M tonnes of new nickel required for EV market by 2040

Nickel stocks at lowest levels in last 6 years

8-10 years to bring Greenfield Nickel projects into production.

Why Invest in Nickel Now?

Market Fundamental Concepts

Nickel investments are expected to grow in popularity in the upcoming period. The fundamentals of the nickel market, we believe, are pointing in the right direction for investors now and in the future.

With strong demand for stainless steel continuing to expand, as well as major new demand for Electric Vehicles (EVs) and Electric Storage (ES), nickel demand is on the rise.

Nickel demand from EVs is expected to rise to 1.23 Mt by 2040, according to nickel market specialists. To put this in perspective, the global nickel market is currently approximately 2.2 Mt.

Total global nickel demand is predicted to climb significantly by 2040, according to the nickel market analysts. Simply said, in the next 20 years, the nickel market will double.

However, the nickel price is influenced by more than just demand; supply is also a significant component. Nickel prices have remained low in recent years due to high levels of nickel inventories. As demand outpaces supply, stockpiles are decreasing.

Different Types of Nickel: Extinguishing the Myth of Sulphides vs. Laterites

Sulphides and laterites are the two main forms of nickel ore deposits. Many investors believe that sulphide deposits are easier to process (and thus less expensive) because they use less energy. Although nickel sulphide operations used to be less expensive in terms of operational costs, this is no longer the case. Nickel laterite operations have been cheaper to operate on average than nickel sulphide operations for the past years, and we expect this trend to continue.

Diversifying the Nickel Portfolio

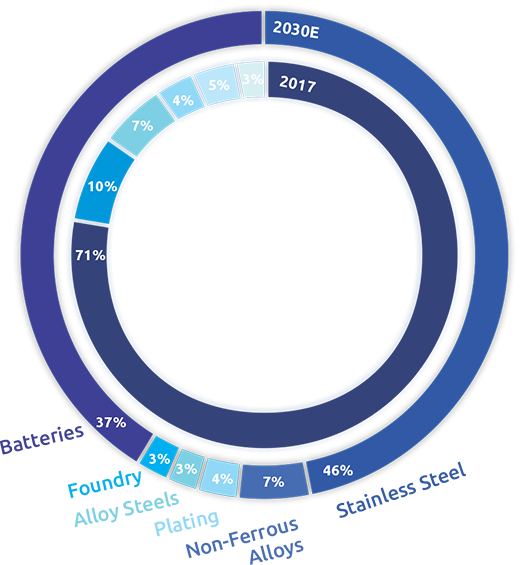

Stainless steel continues to dominate nickel demand, accounting for almost two-thirds of nickel production today. Ferro-nickel or nickel pig ion (NPI) is the most common nickel product, which is also known as Class 2 nickel.

As we move closer to an electrified world, the demand for metals required for EVs and ES is expected to skyrocket. The sort of nickel necessary to create batteries is one of the issues facing the EV battery supply chain. Class 1 nickel, usually in the form of mixed hydroxide precipitate (MHP) or nickel sulphate, is still required. With this in mind, diverting Class 2 nickel appropriate for stainless into the EV battery supply chain is not a simple process.

As the battery business grows, the amount of nickel accessible for other purposes will be limited, as shown by statistics. Overall, rising demand in both the stainless and electric vehicle industries is projected to contribute to nickel price hikes across the board.

Given the current state of the nickel market, we advocate diversifying our clients’ nickel portfolios to assure exposure to both the stainless steel and EV/battery nickel markets, allowing investors to participate in the entire nickel market rather than just a subset. We reduce investment risk and provide longer-term stability by serving both sides of the market.

Conclusions

Because the geology is well studied, good sample selection for test work was possible, resulting in high predictability and recovery in the process plant pilot program. Trial mining has shown the resource model's integrity and underpins the conversion of Mineral Resources to Mineral Reserves, as well as grade control, geotechnical factors, and operability generalizations.

The study's conclusions are obtained from several study sections; nonetheless, the overarching conclusion is that:

- There are enough nickel resources, backed up by data, to convert to nickel reserves to feed the processing plant for more than 20 years.

- The ANP (Acid Neutralization Potential) ore performs well in the selected RKEF (Rotary Kiln-Electric Furnace) process route and will produce nickel to the nameplate design capacity, according to metallurgical tests and pilot plant results.

- The study's social and environmental implications have been examined, and management plans have been prepared to ensure adherence to specific sector regulations and performance criteria.

- The region has enough water and power to serve the processing facility.

- The project economics are solid, with thorough engineering, vendor quotations, and cost projections to back them up.